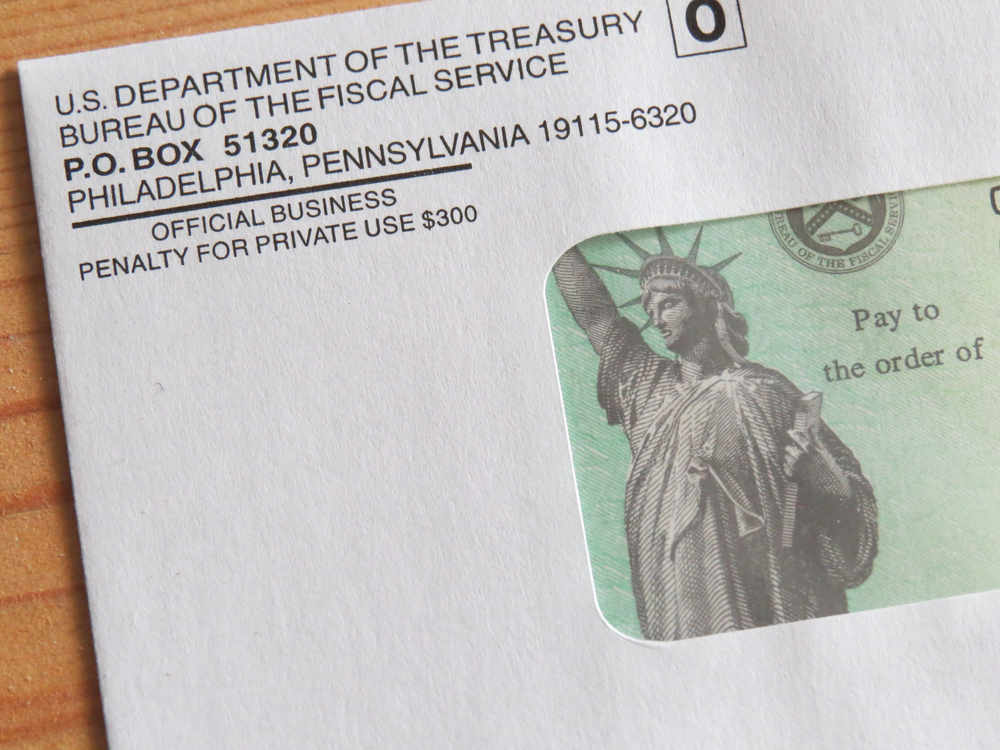

Now that the Senate has passed the latest COVID relief bill, all that is required for it to be signed into law is for the House of Representatives’ approval. If the bill passes its scheduled vote on March 10, President Joe Biden is expected to authorize the bill with his signature and then the checks can start to go out. “This plan will get checks out the door starting this month to the Americans that so desperately need the help,” Biden said at a press conference on March 6.ae0fcc31ae342fd3a1346ebb1f342fcb According to Garrett Watson, senior policy analyst at the Tax Foundation, those who received their past two stimulus payments as a direct deposit should start seeing the funds arrive in their bank accounts within two weeks. For some, the bill’s passage should initiate payments that will start arriving within days, CNN reports. If your banking information isn’t on file with the IRS, you may be waiting a little longer for your money to arrive. Watson told CNBC that those who previously received direct payments as debit cards or physical checks may see delays as long as April or May for them to make it to their mailboxes. Still, Watson remained confident that this rollout of funds will likely be quicker than previous payments, despite the crunch of tax season potentially slowing down the IRS. “The good news is that there is a bit more infrastructure and a more formalized process to do this than this time last year, because they’ve been through it twice,” he told CNBC. And for more on whether or not you’ll see another payment, check out This Is Why You May No Longer Qualify for the Next Stimulus Check. But not everyone who has collected a COVID stimulus payment will see one this round. As a part of late negotiations, Biden agreed to stricter income limits on the third stimulus checks in hopes of garnering more bipartisan support for the bill, according to The New York Times. The Senate approved the proposed change that lowered the income caps from the previous stimulus checks by $20,000, meaning that no individuals making more than $80,000 and no couples with incomes exceeding $160,000 will receive payments. Single parents who make more than $120,000 will also no longer be receiving a payment. Now, only individuals making $75,000 or less will receive full $1,400 checks, as well as couples making a combined income of $150,000 or less and single parents making $112,500. But those who make more than the set amounts will gradually see their payments decrease, capping out completely at the $80,000-, $120,000-, and $160,000-mark for individuals, single parents, and couples, respectively. The salary caps may be different between this stimulus package and the previous ones, but a major life change may mean you still qualify for a payment. If you’ve seen a salary reduction, lost a job, or had a child since you filed your 2019 taxes, updating your information with a more recent filing could help secure a check, CBS News reports. Those who are still waiting on previous stimulus checks may want to consider filing, as well: any missing payments could still make their way to those who qualify in the form of a tax credit. Doing so will lower the amount of money you owe or increase the size of your tax return, AARP reports. And for more on when the pandemic may take another bad turn, check out Dr. Fauci Says This Is the Sign That We’ll Have Another COVID Surge.